Our Tax Pros

Get The MAX Refund!

Relieve the stress this tax season with the assistance of a professional tax preparer.

Why Choose Us??

Who Our Services Are For

Individuals

W2 EMPLOYEES

STUDENTS

Self employed

ENTREPRENEURS

GIG WORKERS

INVESTORS

SMALL BUSINESSES

FREELANCERS

Up To

Refund Cash Advance

SERVICES

TAX PREP

We get you the MAX refund

Receive every credit & deduction

Option for 100% virtual process

Guarantee 100% accuracy

Tax Prep Services

TAX PLANNING

Create strategies for MAX savings

Dedicated mentor throughout year

More customized plan of attack

Year round consultant

Tax Planning Services

CREDIt REPAIR

Remove negatives from credit

Add AU & Primary tradelines

Create plan to reach your goals

Position you for Funding

Credit Repair Services

We work harder for you!

At Quick File Tax Services our tax professionals work diligently to uncover EVERY deduction and credit you deserve, so you can keep more of your hard earned money.

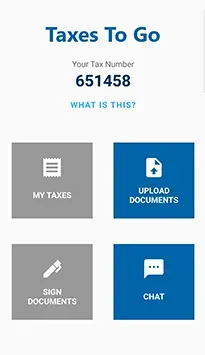

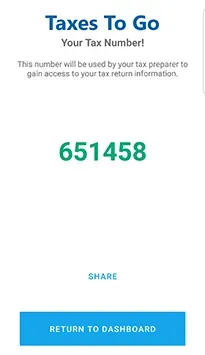

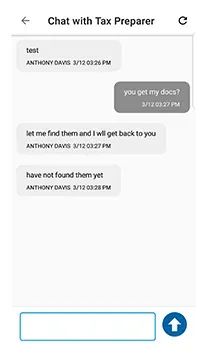

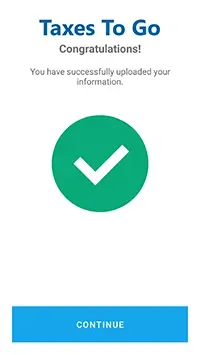

Get the mobile app

Make the process seamless

With the Taxes ToGo mobile app you can experience the entire process from the palms of your hands. Our main goal is to make it all as stress-free as possible.

Input all personal info securely.

Upload tax forms and documents right through app.

Review and sign compete tax returns in minutes.

No need to visit an office. Conveniently complete the process remotely.

2-way messaging with your dedicated tax preparer directly through the app.

Check on the status of your return and refund at any time.

Multi-factor authentication to ensure your data is safe, secure, and remain confidential.

Full access to all of your info and returns.

Filing Your Own Taxes can be intimidating

Whether you're an entrepreneur, self employed, a freelancer, or W2 employee, you'll receive nothing less than our greatest service. Allow us to take care of your tax needs so that you can focus on the other things that matter most to you

Great Customer Service that focuses of results

We eliminate the errors that would occur if filed yourself

We save you a mountain of time by filing for you

We offer Audit Protection so you know you're protected

Guaranteed higher refund compared to DIY filers

And soo many other reasons to choose Quick File Tax...

Getting started...

Easy as 1, 2, 3

Click the

GET STARTED

Button....

Great Job!!

you've taken that first step.

Fill out a

Personal Info

form.....

Complete the "Info Form" with a few basic pieces of personal information.

Schedule your FREE consultation.

Pick a date and lock in your FREE consultation with one of our trusted tax preparers.

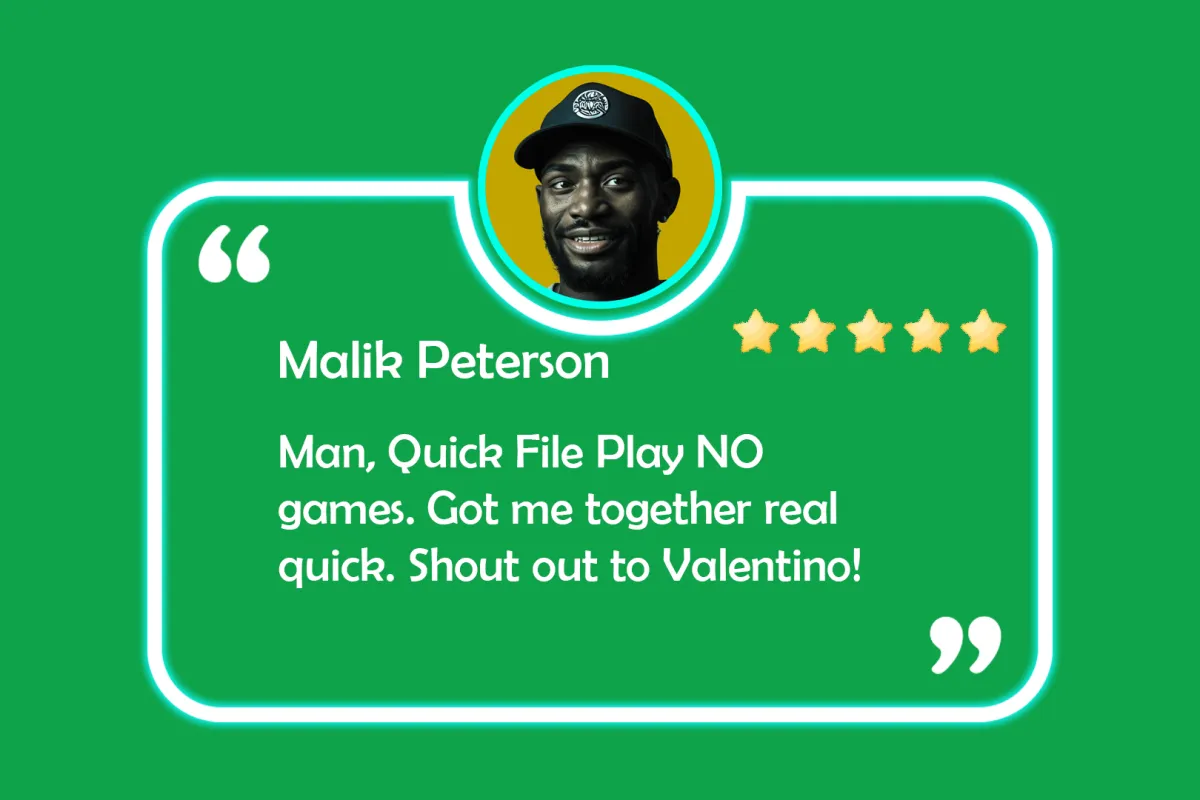

What are clients saying about us...

Frequently Asked Questions (FAQs)

Explore Our Common Questions

Services Offered

Quick File Tax Services offers a range of services, including individual and business tax preparation (basic and complex returns), tax planning strategies (throughout the year), and credit repair services.

What Is Tax Prep?

Tax preparation involves preparing and filing your tax returns with the relevant tax authorities (IRS and state).

We help you navigate the tax forms, identify eligible deductions and credits, and ensure your return is accurate and filed on time.

What Is Tax Planning?

Tax planning is a proactive approach to minimizing your tax liability throughout the year.

Using your unique situation and our experience/knowledge we utilize more advance financial techniques and tax strategies to assist you in becoming more financially secure.

We work with you to develop strategies that take advantage of tax laws and regulations to reduce what you owe and keep more of your hard earned money.

What Is Credit Repair?

Credit repair helps you improve your credit report and score.

We offer both personal and business credit solutions.

Our services include reviewing your credit report, disputing inaccurate information, adding AU & primary tradelines, and developing powerful strategies to build positive credit.

Our mission is to position you for personal and/or business funding so that you can achieve your overall financial goals.

Tax Prep Cost?

Our tax preparation fees vary depending on your situation and the complexity of your return.

Basic 1040 returns typically start at $250 -$400, while more complex returns involving Schedule C, multiple income sources, or other factors will be priced accordingly.

We offer a free consultation to review your specific situation and provide an accurate quote.

Tax Planning Cost?

Tax planning fees are typically based on an hourly rate or a fixed fee depending on the scope of the services provided.

We offer a free consultation to discuss your tax planning needs and provide you with a customized quote.

Credit Repair Cost?

Credit repair pricing depends on the specific services you need and the complexity of your credit situation.

Pricing options include a flat fee, payment plan, and other more customized options. Credit repair prices start at $400 and up.

We offer a free credit consultation to discuss your needs and provide a personalized quote.

Can I Pay Tax Prep Fees From My Refund?

Yes

We do offer this option. Although, it is based on a client by client basis.

Usually, our fees are directly deducted from your expected tax refund amount and the remaining balance is paid to you via the payment method you chose during signup.

We also offer you the option to purchase our other services (such as credit repair) directly from your anticipated refund amount. This means you would have $0 out of pocket costs. As we will deduct the overall cost of services purchased from your tax refund and you will be paid out the remaining balance. Making it easier for you to afford our services and improve your financial situation.

How Long Does Tax Prep Take?

The time required for tax preparation depends on the complexity of your return.

Simple returns can often be completed within 1-4 hours, while more complex returns may require additional time.

We will give you an estimated timeline during your initial consultation.

How Long Does Tax Planning Take?

Tax planning is an ongoing process. Not a one time transaction.

We will work with you throughout the year to develop and implement tax-saving strategies.

We will create a plan of action that reflects your goals during your initial consultation.

How Long Does Credit Repair Take?

Credit repair is a process that takes time.

Results can vary depending on the specific issues on your credit report and your commitment to the process. Past clients have seen amazing results as soon as 1 month. Others have taken longer.

We will provide you with a realistic timeline during your credit consultation.

How Long To Receive My Refund?

The IRS typically issues refunds within 21 days of accepting your return if you e-file. However, processing times can vary. The IRS will inform us if they need additional info from you. This could prolong the date you receive your refund.

You can track the status of your refund with the IRS "Where's My Refund" tool at irs.gov/refunds.

Refund status is available 24 hours after your current year return has been e-filed (electronically filed).

For more info directly from the IRS website click HERE.

Documents Needed From Me To Start?

The documents you'll need depend on your individual tax situation.

Generally, you should have your Social Security card(s), W-2s, 1099s, records of any income or expenses (including business expenses if self-employed), dependent's info, and any other relevant tax documents.

Based on your unique situation, we can provide you a more detailed checklist during your free consultation and onboarding.

Click HERE for a list of personal documents needed to start.

Click HERE for a list of most common tax forms filed.

Do You Offer Any Discounts?

Yes

We offer a number of discounts for our clients depending on their situation.

1) COUPLES

Couples receive a 20% discount each if signed up together, as new clients.

2) NEW CLIENTS

New clients receive a 10% discount on tax prep and credit repair.

3) SENIORS

Seniors (age 60 or over) receive a 15% discount on tax prep services and credit repair. This discount applies to new and existing clients.

Are You On Social Media?

Yes.

You can find us on:

1) Facebook

2) Instagram

3) YouTube

4) TikTok

4) LinkedIn

Payment Methods You Accept?

We accept the following payment methods to pay for services:

1) Directly taken from your tax refund.

2) Debit and Credit card.

3) Stripe

4) ACH Payments

Do You Offer Both Paper & E-Filing?

Yes

We primarily offer electronic filing (e-filing) as it is the most secure and efficient way to file your taxes.

Although, if you require paper filing (special circumstances and prior year returns) we office this service also at a small additional fee.

Who will be working on my return?

Your tax return will be prepared by one of our experienced tax professionals.

Each one of our trusted tax professionals have been meticulously vetted.

Our team is comprised of knowledgeable tax professionals with years of experience filing returns just like yours.

What If I Owe The IRS?

If you owe the IRS don't stress.

Quick File Tax Services understand that dealing with tax debt can be challenging.

We can assist you in making any payments you owe to the IRS. We can also assist you in next steps if payment isn’t possible by the deadline.

Missing Tax Day may lead to additional penalties and interest. Although, imprisonment is rare.

It’s wise to file your return on time or request an extension from the IRS, even if you can’t pay immediately.

Consider options like payment plans to help effectively manage the amount you owe.

How Do I Find Out If I Have A Tax Offset?

A tax offset can make anyone frustrated. Especially If you are owed a refund and are looking forward to those funds to pay bills and handle important business. Whatever’s left of your refund once the offset amount has been taken will still make its way to you.

The Bureau of the Fiscal Service (BFS) is in charge of sending out IRS tax refunds, but they can take a slice of it to cover debts like:

1) Unpaid child support,

2) Overdue state or federal taxes,

3) Student loan debts,

4) or certain unemployment overpayments.

If this happens, BFS will send you a notice with all the details about who got your money and how much was taken.

Got questions or disputes? Chat with the agency listed on the notice.

To determine whether an offset will occur on a debt owed (other than federal tax), contact BFS's TOP call center for help at:

800-304-3107

I Haven't Filed Taxes In Multiple Years...What Do I Do Now?

Its very important to file your federal income tax during the year they are due and before the deadline to prevent penalty.

Not filing a tax return on time can lead to big fines or even jail.

The government has six years from the due date to bring charges, but filing late on your own reduces this risk.

Life challenges might cause delays, but ignoring taxes for years can lead to worse penalties.

Filing, even after a long delay, helps avoid bigger problems.

If, for any reason, you haven't filed previous years tax returns we can assist you in doing so.

Working with our tax professionals will help you get back in good standing with the IRS.

Click "Get Started" to schedule a free consultation with one of our tax professionals to craft a game plan to get you back on track.

Are There Any Resources For Taxpayers Who Don't Have The Funds To Pay What They Owe?

The IRS have programs to assist taxpayers who don't have the available funds to satisfy their tax debt.

An "Offer In Compromise" is a legitimate IRS program that lets qualified taxpayers settle their tax debt for less than the full amount they owe. It may be an option if they can't pay their full tax liability or doing so creates a financial hardship. The IRS considers a taxpayer's unique set of facts and circumstances when deciding whether to accept an offer.

There are also repayment plans and even third party relief options.

Can You Communicate With The IRS On My Behalf?

Yes,

Quick File Tax Services can communicate with the IRS on your behalf.

There are different ways to communicate with the IRS on your behalf and also different types of third party authorizations:

1) Power of Attorney

Allow someone (us) to represent you in tax matters before the IRS.

This representative must be an individual authorized to practice before the IRS.

You (we) will need to complete the following forms beforehand to grant us this permission:

- IRS Form 2848

- Power of Attorney and Declaration of Representative

This can be submitted online, by fax, or mail.

Quick File Tax Services can assist you with obtaining and completed the required forms.

2) Tax Information Authorization

Appoint anyone to review and/or receive your confidential tax information for the type of tax and years/periods you determine.

3) Third Party Designee

Designate a person on your tax form to discuss that specific tax return and year with the IRS.

4) Oral Disclosure

Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with us about a specific tax issue.

Sign up for you free consultation and lets create a game plan to get you going.

How Do I Access My Federal Tax Records and Transcripts?

You can access tax records and transcripts in your Individual Online Account.

It's easy to sign up for an online account.

First, visit https://www.irs.gov/your-account and click the "Sign in to online account" button, under "Individual".

Next, sign in to your ID.me account for identity verification. If you don't yet have an ID.me account select Create an Account to begin the identity verification process. ID.me is a secure online service that verifies identity. It's used by businesses, governments, and consumers.

Make sure to have your ID handy for this step.

Once you have verified your identity and created an individual Online Account you can access your personal tax records online or by mail, including transcripts of past tax returns, tax account information, wage and income statements, and verification of non-filing letters.

To get your tax transcripts by mail go to https://sa.www4.irs.gov/oat/.

Why Choose Quick File Tax Service?

Quick File Tax Services is committed to providing accurate, affordable, and personalized tax preparation, planning, and credit repair services.

We work diligently to uncover every credit and deduction for your business.

Our goal is to help you keep as much of your money as possible to reinvest into yourself and your business.

We offer a free consultation to review your specific situation and provide a plan of action.

Do You Specialize In Any Business Tax Prep?

We prepare tax returns for a broad range of business types. Our focus is on providing comprehensive tax services to meet the diverse needs of our clients.

We don't focus on any one business category. Our services are available for self employed, gig workers, freelancers, entrepreneurs, and small businesses of all kind.

What Business Records Should I Keep Throughout The Year For Tax Time?

We advise that your keep records of all your business expenses throughout the year. Remember, the IRS states that any expense you deduct must be "Ordinary & Necessary" and directly related to your business activities.

Click HERE to visit the IRS' website for further details.

This includes (but not limited to):

Phone expenses

Utility expenses

Home office expenses

Vehicle expenses

Mileage logs

Assets purchased

Purchase Receipts

Insurance Info

Business investments

Invoices

canceled checks

and much more...

We offer a free consultation to review your specific situation and provide a plan of action.

My Business Don't Have An LLC or EIN. Can I Still File?

Yes

If you conduct business without an LLC, Corporation, or EIN, you are most likely considered a Sole Proprietor.

A Sole Proprietor is someone who owns a unincorporated business by themselves.

Sole Proprietors report their business income and expenses on their personal tax returns (Form 1040). They use form Schedule C (Profit Or Loss From Business) to report this information.

We offer a free consultation to review your specific situation and provide a plan of action.

What's The Deadline For My Business To File?

The deadline for a business to file federal taxes depends on the type of business and its tax year. Also, whether you are a calendar year business or a fiscal year business.

Here's a general overview for the 2024 tax year (filing in 2025):

[Calendar Year Businesses]

C Corporations - April 15th, 2025

S Corporations - March 17th, 2025

Partnerships - March 17th, 2025

LLCs - March 17th, 2025

Sole Proprietorships - April 15th, 2025

(as part of the individual tax return)

[Fiscal Year Businesses]

If your business operates on a fiscal year (any tax year other than January 1 -December 31), the filing deadline is generally the 15th day of the third or fourth month after the end of your fiscal year, depending on the type of business.

How Do I Get Started?

You can get started with Quick File Tax Services by:

1) Clicking the "Get Started" button on our website, completing the "Info Form", and scheduling a free consultation.

Click HERE to get started now.

-or-

2) Contacting us via phone at (414)279-5588.

Mon - Sat: 9am - 7pm

[NOTE: Contacting Quick File Tax Services via phone will still result in the need to scheduling a FREE consultation to determine your level of service and plan of action.]

Do I Have To Come To Your Office?

No, at Quick File Tax Services we also offer a virtual experience.

From your FREE consultation to ongoing services we make the process easier and more convenient for you throughout the entire process.

This includes Zoom sessions, phone calls, correspondence through our app, secure client portal, etc.

How do I contact You?

You can contact us through the following:

1) WEBSITE

Clicking the "Get Started" button on our website, completing the "Info Form", and scheduling a free consultation.

Click HERE to get started now.

2) PHONE

Contacting us via phone at (414)279-5588.

Mon - Sat: 9am - 7pm

[NOTE: Contacting Quick File Tax Services via phone will still result in the need to scheduling a FREE consultation to determine your level of service and plan of action.]

3) CUSTOMER SUPPORT

You can also contact customer support via email with any issues you may have. Although, customer support is only available to existing customers. To contact Quick File Tax Services with inquiries or issues as a non-customer please use the other methods of contact mentioned above ((1) Website, and (2) PHONE).

How To Check Refund Status?

You can track the status of your refund with the IRS "Where's My Refund" tool at

Refund status is available 24 hours after your current year return has been e-filed (electronically filed).

How Do You Communicate With Clients?

We communicate with clients primarily by phone, email, app, and secure client portal.

We strive to respond promptly to your inquiries and keep you informed throughout the process.

What Is The Onboarding Process?

After your FREE consultation you will receive an email from Quick File Tax Services with instruction on what to do next.

You will receive a link to download the tax app and another email that provides you access to your secure client portal.

How Do I Get Access To My secure Client Portal?

To access your secure client portal you will use the login link sent to you by Quick File Tax Services after successfully signing up for our service(s), through an email invitation.

This email will give you specific instructions on how to access your secure client portal login.

Here, you can view your specific client information and interact with our services within the portal.

Once you've followed these steps and have gained access, you can also access you secure client portal by clicking the "Client Login" button in the top right corner of the website.

Is My Personal Information Safe. Do You Share It?

Your personal information is 100% safe with us. We take your data protection and security seriously.

It is our #1 priority outside of providing you a great experience.

At times we may offer our existing clients and prospective clients promotional services provided by third party providers. Such as benefits, luxury cruise trips, gifts, etc. These third party provides may need certain personal information to provide you with their services.

In the event that there is a need to share your information for any of the above reasons, you will be given the option to accept or deny participation in any of these promotional services.

Do You Have An Referral/Affiliate Program?

Yes

To join our referral/affiliate program click the menu tab at the top of the site and complete the form with your info. You will receive an email link or SMS with next steps.

OR

Click HERE

How Much Can I Make Per Referral?

Our referral/affiliate program compensates $50-$100 per referral.

This amount is contingent upon services new clients subscribe to. Ex: tax prep, tax planning, credit repair, business funding, etc.

Payout for this program is once per month.

To join our referral/affiliate program click the menu tab at the top of the site and complete the form with your info. You will receive an email link or SMS with next steps.

Or, Click HERE

How Do I Track My Referral/Affiliate Earning?

After signing up to become an affiliate you will receive an email with your affiliate link and QR code. This link and QR code is what you will put on your social media pages, your website, or send to others you refer to our services.

To join our referral/affiliate program click the menu tab at the top of the site and complete the form with your info. You will receive an email link or SMS with next steps.

Or, Click HERE

Join Our

Affiliate Program

BECOME A PARTNER

Refer Our Services,

Earn A Commission

Sign Up Today & Earn Big

Simple setup, fast payouts.

Grow your income steadily.

Succeed with a trusted partner.